|

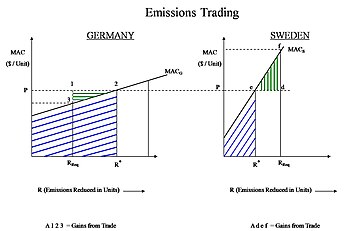

| Emissions Trading Economics of 2 Countries (Wikipedia) |

The Carbon Pricing Mechanism, known to its friends as the carbon price and its critics as the carbon tax, passed away today in Canberra, aged two, after a long battle with slogans.

While it won praise from most academic and business economists at home and abroad, it will perhaps be best remembered for its controversial relationship with Australian voters, the stinging criticism it endured from certain politicians, and comparisons with its nemesis, Direct Action.

While no-one thought it was perfect, the carbon price was achieving the task that was asked of it, and won expert recognition as an important pillar of any sensible climate policy portfolio.

Passionate origins

The carbon price was conceived in the throes of passion of market theory. Pollution has a social cost, so it seemed like a good idea to economists to incorporate these costs into the market system, with its respected properties of being relatively good at allocating resources and minimising costs.

Its backers had big ideas. Incentives to lower emissions would permeate throughout the economy from bolstering low-carbon investment, encouraging consumers to switch into low carbon goods and services, and supporting technological and social innovation. Emissions-reduction efforts could also be easily scaled up by raising the carbon price or reducing the number of permits for sale.

But the carbon price kept its feet on the ground, always aiming for a humble target of a 5% cut in Australia’s emissions by 2020, even though its cousin, the Climate Change Authority, advised it to shoot for 19% to be closer in line with what other countries were doing.

A difficult birth

With such a strong market-theory pedigree, one would have thought that the Coalition - usually ardent fans of incentives and market forces - would have gleefully awaited the carbon price’s birth.

Indeed, they were part of the pregnancy. Both the Coalition and Labor contested the 2007 federal election promising an emissions trading scheme.

One of those who later turned against the carbon price, environment minister Greg Hunt, had previously written an undergraduate honours thesis on the benefits of pricing pollution. Even future Prime Minister Tony Abbott said in his 2009 book Battlelines that it seemed to be the “best way to obtain the highest emission reduction at the lowest cost”.

But then came the event that presaged the carbon price’s untimely death: the fall of liberal leader Malcolm Turnbull and Abbott’s election as the new leader by one vote, supported by climate sceptics within his party.

Almost overnight, the admiration for carbon pricing disappeared.

Thus, before the carbon price was even born, it was branded as a pointless and bloated fetus, a “great big new tax on everything” - despite the fact that it was designed to return its revenues to the public through tax cuts and benefits, and the fact that this slogan came from a party that actually did bring in a tax on (nearly) everything: the GST.

Amid the controversy, the carbon price finally arrived on July 1, 2012, delivered by the Labor-led minority government after the extremely close election of 2010.

And while its gestation may have been troubled, its life would be even more difficult.

Before the election, then Prime Minister Julia Gillard famously said there would be “no carbon tax under a government I lead”. But she also said that Australia needed to have an emissions trading scheme (and was of course part of a government that had already tried twice to introduce one in the form of the Carbon Pollution Reduction Scheme).

In fact, the carbon price was really an emissions trading scheme, albeit one designed to spend its first three years imitating a tax before moving to a floating price.

Gillard admitted as much, choosing to call it a tax rather than engage in semantics, in the hope that the discussion would quickly move on.

It didn’t - Abbott relentlessly pursued the “great big tax based on a lie”. The carbon price would come to regard this as a bit unfair as Abbott would later deny breaking a promise not to introduce new taxes, on the basis that his proposed budget repair levy would only last three years.

Post-fact politics

Throughout its career, the carbon price tried to ignore the barracking from the sidelines, and focus on its task of lowering emissions.

The Treasury predicted that there would be modest emission reductions and very mild impacts on gross domestic product, employment and inflation.

In contrast, Abbott declared that the hit on Australians' cost of living would be “almost unimaginable”. Carbon pricing would “destroy the steel industry, the cement industry, the aluminium industry”. Whyalla and Port Pirie would be “wiped off the map”.

And so what happened after two years of carbon pricing? Pretty much just as the Treasury and the other modellers predicted.

Economists found it difficult to find any macro-economic effect beyond a small increase in the consumer price index in the first quarter after it was introduced. Hardly the “wrecking ball” predicted by Abbott.

As expected, electricity prices rose (by approximately 10%), and the price impacts elsewhere were negligible. Companies such as Woolworths said that they had absorbed any price impacts and passed nothing on to consumers.

Meanwhile, emissions covered under the scheme fell. In the electricity sector, the main sector that the carbon price was expected to impact, they fell spectacularly - more than 8% in two years.

However, most analysts agreed that the carbon price was only one factor among many in driving this fall, including the effect of the Renewable Energy Target. Still, not bad considering the carbon price’s long-term incentives had been crushed by Abbott’s pledge to get rid of it.

By now, however, the political attacks had become so entrenched that no amount of inconvenient facts could dislodge them. The carbon price’s new moniker was the “toxic tax”, and that was all you really needed to know.

The Coalition and other critics would seek to find new inventive ways to spin the story that the price was not working or damaging the economy. This included ignoring baselines - how emissions would have been behaving without the policy.

Rises in electricity prices were almost always blamed exclusively on the carbon price and its cousin, the Renewable Energy Target, despite report after report showing their contribution was minor.

Similarly, the carbon price shouldered the blame for any business - from multinational companies to lemonade stands - that ceased or reduced operations, even when the enterprises explicitly denied it.

Its critics also played down the various compensation packages designed to minimise the impact on low-income families and emissions-intensive sectors like the aluminium industry from being adversely affected in international markets.

This is the end?

In its dying weeks, the carbon price sometimes couldn’t tell whether it was hallucinating.

Within days of Joe Hockey crowing over the strength of the Australian economy, having put on 100,000 new jobs, much of it in the sectors the carbon price was supposed to be destroying, it thought it saw Tony Abbott on television on the other side of the world claiming that carbon taxes are “job killing” and would “clobber our economy”.

Now exhausted, the carbon price only had the strength to sigh.

It died six weeks later.

Mourners are asked not to send flowers, but rather to help conserve the water, as Australia has just smashed another temperature record for the 12 months to June, with increasing signs of another El Niño this year.

There will be no viewing of the body, however new incarnations of carbon pricing are springing up around the world, despite claims to the contrary by the Prime Minister. This year alone, new emissions trading schemes have begun in seven regions and cities in China, and in California. South Korea is also set to launch a national emissions trading scheme on January 1 next year.

In its final days, the carbon price obsessed over how it could all have been so different and the various events that may have taken its life in a more friendly direction.

Cryptically, its dying whisper was “Utegate”.

The Carbon Pricing Mechanism is survived by several relatives, including the Climate Change Authority, Clean Energy Finance Corporation, the Australian Renewable Energy Agency and the Renewable Energy Target, albeit all in precarious health. It was preceded in death by its mother, the Department of Climate Change, and its brother, the Climate Commission.

The Carbon Pricing Mechanism, 2012-2014.

Paul Twomey does not work for, consult to, own shares in or receive funding from any company or organisation that would benefit from this article, and has no relevant affiliations.

This article was originally published on The Conversation. Read the original article.

No comments:

Post a Comment