|

| Chinese coal miners in an illustration of the Tiangong Kaiwu encyclopedia, published in 1637 (Photo credit: Wikipedia) |

We have to admit we haven’t paid a lot of attention to the dry bulk shipping industry, but these graphs from what will soon be the biggest dry bulk company in the world caught the eye of a reader, and ours too.

They come from the third quarter report of Golden Ocean, which is merging with the Knightbridge to form the biggest company of its type - shipping coal, iron ore and other dry commodities across the globe.

They give a sobering account of the thermal coal market. Sobering, at least, for Australian companies hoping to have a market to underpin the development of massive new coal mines and infrastructure in Queensland.

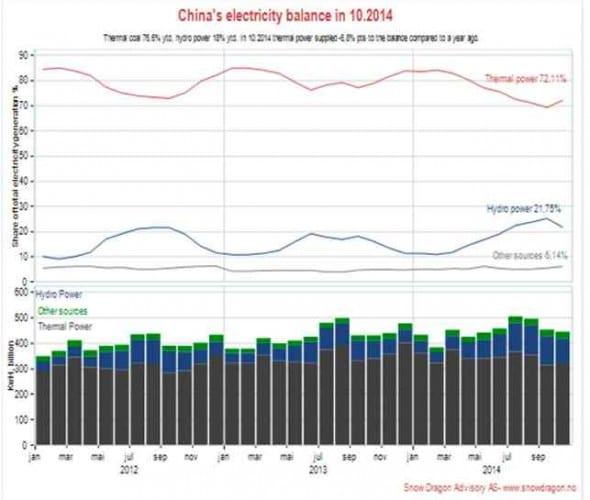

China last week announced that it would likely cap coal use by 2020, but many analysts think it will happen a lot earlier than that. This graph below suggests that it may have already occurred.

Golden Ocean notes that thermal generation (i.e. coal) has fallen in

absolute terms and its share of the electricity market has fallen to

72.1% in October, a fall of 6.8% in just one year. That is an extraordinary reduction

given the size of the market. Hydro power has accounted for most of

that change, along with wind, solar and nuclear.

This is not good news for

companies such as Golden Ocean, which had been expecting growth in coal

imports of more than 7.5% in 2014. Instead, it fell by more than

10%. On an annualised basis, the third quarter coal imports

were down by a third.

In

an effort to shore up the domestic mining industry, China has

introduced a set of policy measures that are intended to make coal

imports more costly, including tariffs on thermal coal for Australia.

As

Golden Ocean notes: “The Chinese policy makers seem to be willing to

retain as much as possible of domestic production in the energy mix.

Branded as an environmental policy, new criteria on ash and sulphur

content have been set for coal being used, sold and imported.”

Golden Ocean hopes that - given that the Chinese coal shipping market has collapsed, India might offer another avenue of growth. It

is convinced that coal will remain the main energy source in India, and

that will be import dependent because the supply of domestic coal is

not reliable, and it is of inferior quality.

But

it includes a couple of caveats: It says that for that to occur,

subsidies need to be removed so that the full cost of imported coal can

be passed on to consumers. “Consumer electricity prices/tariffs will

have to be increased,” it said. “Electricity must not be subsidised.”

The

problem with that is that it leads to greater competition from wind and

solar, which is already competing with the cost of imported coal. It is

focusing on solar and storage to bring electricity to the more than 50

million homes that currently do not have access. And while the new

Indian government has also vowed to increase domestic coal production,

but possibly phase out imports within a few years.

No comments:

Post a Comment