|

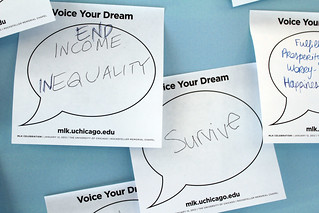

| (End) Income (in)equality (Photo credit: quinn.anya) |

Commentators around the world see the growing gap in incomes of

the richest and poorest as a destabilizing force with the potential to

cause massive political and social upheaval.

What I don’t see, however,

are impact investors talking about one of the most critical issues

facing us as a global society: income inequality.

The author of this post, Bruce Campbell

has 15 years of experience as a corporate attorney, representing

ventures from the smallest startups to Fortune 100 companies. Bruce

brings a true depth of expertise to serve social impact funds and

entrepreneurs.

Capital owners continue to see very healthy returns on their investments at the same time that wages for most workers are declining.Impact Investors seek to address the biggest issues of our time through market based approaches. Often, they invest in projects that many would consider the responsibility of government, for example: clean water, sanitation, energy access and education.

What I don’t hear, however, are impact investors talking about one of the most critical issues facing us as a global society: income inequality.

Commentators around the world see the growing gap in incomes of the richest and poorest as a destabilizing force with the potential to cause massive political and social upheaval.

In the United States, the richest country in the world, President Obama recently declared income inequality as the “defining challenge of our time” and the number one priority for his remaining time in office.

And in a report last week from the World Economic Forum, a group of 700 global experts concluded that income disparity is the most likely risk to cause severe economic and social crisis on a global scale in the next decade.

Who will lead the effort to a fairer distribution of wealth, if not impact investors?Is there anything that impact investors can do about the global problem of income disparities? Given that a leading cause of the global wealth gap is the dramatic growth in investment returns in recent years, it seems a question worth considering.

As one commentator put it, “It is great that this investment is occurring - without it the world’s poor would be poorer. But the distribution of benefits from that investment isn’t an act of God. It’s a decision of man - and it can be changed.”

As a starting point, I wonder if there shouldn’t be more discussion around what is an appropriate or fair return on investment.

Should an impact investor, for example, always take the maximum return offered by an investment, or should there be some consideration for whether the return is fair given how employees are compensated over the period of the investment?

Is it fair, for example, if an investment returns 20% per year over a five year period - doubling the investor’s money - but the employees of the company have negative wages measured against inflation?

Perhaps a 2x return is the market rate, but should impact investors be led by markets that are seemingly blind to principles of sustainability and fairness?

Should this be the work of governments or individual citizens?Investors, of course, need to look at investments on a portfolio basis. I know that many impact investing pioneers believe it is important to demonstrate that impact investment portfolios can perform as well or better than traditional portfolios.

The hope is that evidence of high performance impact portfolios will encourage institutional investors to consider an impact investing strategy. I see the merit in this approach and appreciate the significance of potentially moving large volumes of money into impact investing.

On the other hand, it seems that this approach essentially means that impact investors are benchmarking against market rates.

If that is the case, who then is left to lead a conversation around whether market rates of return are fair and supportive of an inclusive global financial system? Who will lead the effort to a fairer distribution of wealth, if not impact investors?

In talking to one impact investor, he suggested that market interventions to rebalance wealth should be the work of governments, not individual citizens. But impact investors regularly step in to address issues that governments are unable or unwilling to address.

Why should it be any different with income inequality? Can we really expect governments, like the deadlocked one we have here in the U.S., to lead us into a different way of thinking about our relationship to money and how profits should be shared between capital and those that produce the world’s goods and services?

Of course, this leads us to the question of how to determine what is the appropriate return on a particular investment. I don’t have the full answer, but it seems we need to be willing to think less - or perhaps not all - about how much money could be made if the same money were invested somewhere else.

It becomes critical, I think, to consider how employees of the company are compensated relative to investor gain. And another possible factor is how much of a return a particular investor needs based on the investor’s financial circumstances.

In the public company context, structural change will be more difficult as it will require large groups of diverse shareholders to assert pressure on boards and management teams.

In private equity, however, we could start to experiment immediately with new investment and profit sharing models. Here’s one possible model for how profits could be shared that I thought of while writing this blog:

- First, the company pays investors an agreed upon amount to cover the investors’ direct expenses associated with making the investment (e.g. diligence and legal fees);

- Second, the company pays investors a minimum rate of return that is adjusted for probability of repayment as measured against a baseline rate (e.g. inflation) but NOT benchmarked against the perceived return that could be expected in the same asset class but from a different investment; and

- Third, any remaining profits, including from an “exit” of the investment, are shared in an agreed upon proportion between the investors and the employees - let’s say 50% each.

For employees, profits could be shared in a variety of forms, such as direct bonus payments by the company and/ or funding an employee equity ownership plan. If an employee equity plan offered ownership of the same class of equity as investors, employees would enjoy the same tax-advantaged rates as investors on any future repurchases or secondary sales.

I haven’t thought through all of the details of the above model, and it assumes that employees of the company are not fairly compensated relative to investor profits - which, of course, will not always be the case.

This blog and the above model are meant to spark a conversation more than to answer all the questions.

And it reflects my belief that in a world in which the 85 richest people in the world own the same amount of wealth as the poorest 3.5 billion, we as individual investors and business people have a responsibility to think critically about how we share the economic benefits of our activities.

No comments:

Post a Comment