| Mohave Generating Station fuelled by coal (Wikipedia) |

New Citigroup analysis says that energy storage will have a profound impact on traditional, fossil energy sources, with coal, oil, gas all affected. It’s good news for renewables though.

As we reported here, Citigroup expects the cost of batteries storage to fall significantly in coming years.

By 2020, it predicts solar and battery storage will reach “socket parity” in some countries, and at the utility scale level it will reach “grid parity” in large parts of the world.

Six overarching impacts include:

Renewables

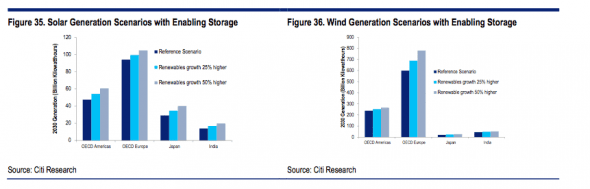

Citigroup says storage is the Holy Grail for intermittent renewables, and deployed at large levels would reduce both the cost of intermittency and the physical grid constraints that prevent deeper renewables penetration. Citi ran three scenarios that increase its base forecast of renewables growth rates in major countries by 25% and 50%. Those results are shown in in the figures below.

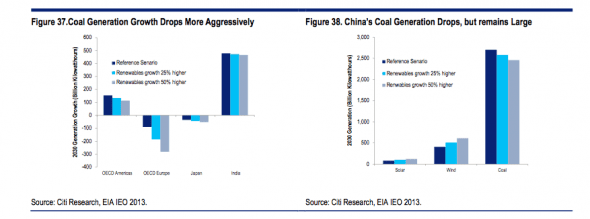

Coal

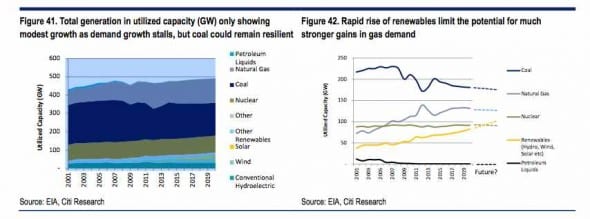

If storage can be competitively used to “firm” intermittent resources, renewables can become a true substitute for baseload generation. In many markets, baseload is dominated by coal-fired power. And because of growing policy pressure to displace coal in markets ranging from the US to China, policy is likely to emphasize the substitution of firm renewables for coal-fired generation.

Oil

Where oil is still used in the global power sector, it is often used in a peaking capacity, and because of its high price is at the top of the bidding stack. That means it will be the most vulnerable to storage. It will be one of the first casualties of widely deployed storage for arbitrage purposes (both utility scale and distributed).

The left figure below shows which countries still rely on oil in their power sectors and thus might experience a backing out of oil demand in the power sector. The right below figure translates this to potential impact on oil demand.

In total, backing all oil out of the global power sector at 2013 consumption levels might decrease oil demand by a maximum of just over 4 million bbls/day, or ~4.5% of global oil consumption (see Alliance Bernstein on consequences of energy price deflation).

Natural gas

Gas is commonly thought of as the substitute fuel for coal in power generation once coal plants retire. But rising renewables generation should increasingly take over market shares of coal- and gas-fired generation, particularly in an environment of slow electricity demand growth such as is the case in advanced economies.

It would pose challenges to the utility model in many countries, as any former base load fuel supply would bring lower returns to the utility based on lost peak/high priced demand loads (this might be especially true in countries with high gas prices, like Australia and Europe). Still, there is a strong role for gas to deliver flexibility and therefore stability to the grid.

Gasoline

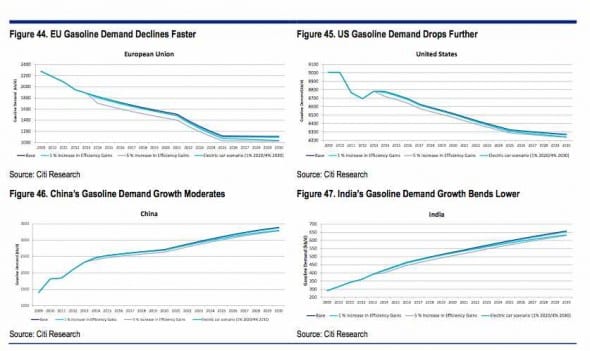

If storage were developed that promoted the growth of electric vehicles, this would significantly erode gasoline demand let alone demand growth, which, along with strong North American production, would put pressure on oil prices.

The structure of power markets

Electricity is one of the few non-storable commodities. Large scale storage could change that, linking spot prices to forward prices in a transformation that would make electricity markets trade more like oil or gas markets. The implications for power forward curves and asset finance could be significant.

Storage will be used in utility scale arbitrage or integration with renewables in a “firming” capacity. Niche ancillary, balancing, or operating reserves markets may be attractive, but will have comparatively lesser impacts on commodities on a large scale.

No comments:

Post a Comment